You may have heard of Bitcoin and other cryptocurrencies. They’ve gotten a lot of media attention lately. You might have even seen or tried out some cryptocurrency exchanges like Coinbase, BTC-e, Bitstamp, and others. But are you sure what cryptocurrency is? What’s its history? What makes it different from fiat currency? Can you hand someone a cryptocurrency for groceries? Can you spend it in an online store? Is validation necessary for security reasons? It’s time to answer these questions and more.

Understanding Cryptocurrency

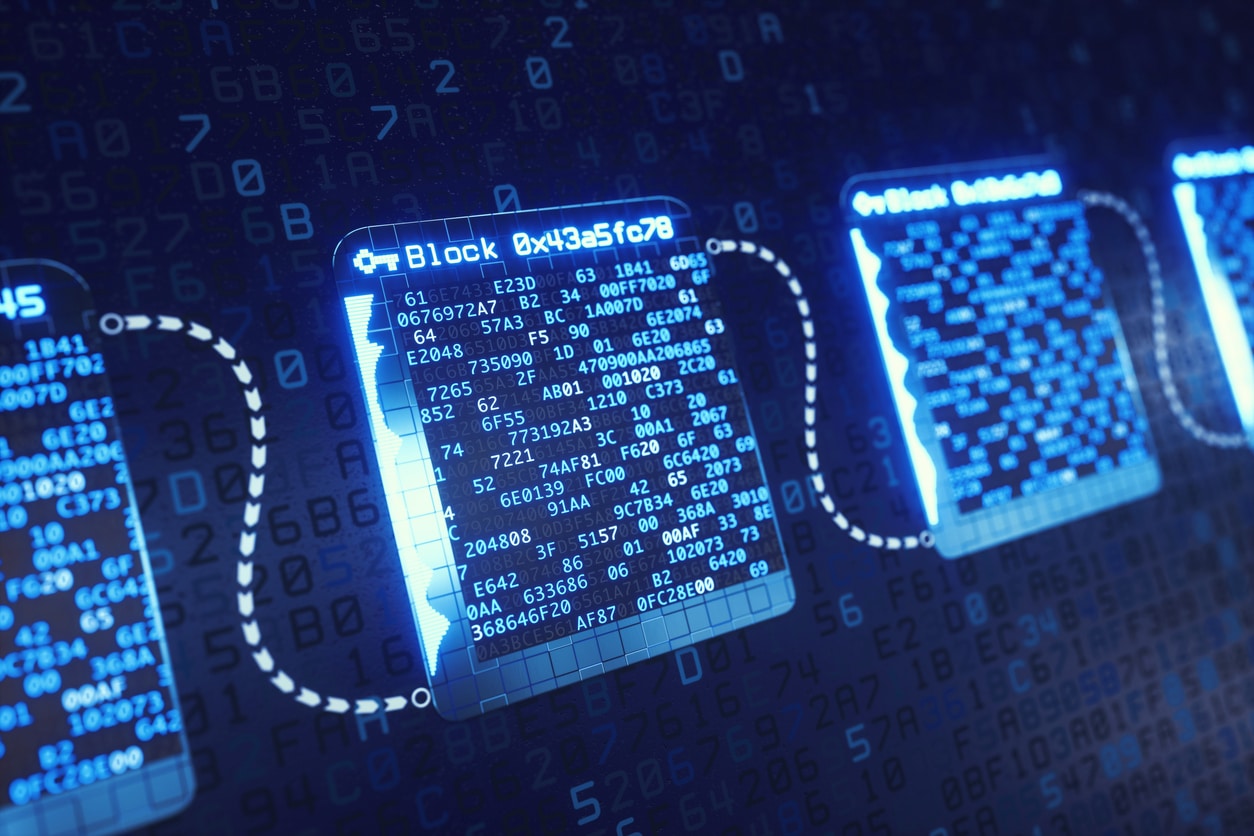

Cryptocurrency refers to a virtual or digital currency that uses cryptography for transaction security and verification. These transactions are then recorded in a blockchain, an online ledger, or a list of records that is incredibly difficult to change retroactively. Governments or other financial institutions do not issue cryptocurrencies; they are generated by complex mathematical equations and run on a global network of computers.

Since its introduction in 2009, Bitcoin has become the most popular cryptocurrency by far. It was the first cryptocurrency ever created and remains the best-known example of this type of digital currency. It was also the first cryptocurrency to implement Blockchain technology, a standard for many altcoins today.

However, there are several other well-known cryptocurrencies. The second-largest cryptocurrency by market cap, Ethereum, was introduced in 2015 and is used for “smart contracts” that facilitate peer-to-peer agreements between multiple parties without requiring an intermediary. Other cryptocurrencies include Litecoin (2011), Ripple (2012), Dogecoin (2013), and Zcash (2016).

What is Bitcoin, and how does it work?

Bitcoin allows users to trade and exchange money in an entirely new way. For the first time, people can instantly send money anywhere in the world without an intermediary. This revolutionary new technology has the potential to dramatically alter the way we use currency on a global scale.

Bitcoin is a peer-to-peer system that allows users to make payments directly from one user to another without using a third-party intermediary. All transactions must be recorded in a publicly accessible ledger called the blockchain to work correctly. The blockchain consists of blocks that contain all the information about previous transactions on the network. Each new transaction is added as a new block on top of the blockchain.

How to get started using Bitcoin.

To get started using Bitcoin, you’ll need a wallet. Think of this like your real-world wallet—the place where you store all your receipts, cash, and credit cards. Your Bitcoin wallet is where you keep track of all your transactions, as well as recent ones, and has built-in security measures to protect your data from hackers.

With your wallet set up and ready to go, you can start sending Bitcoin to other people or businesses that accept it as payment for goods or services. You’ll need either an online wallet (called a web wallet) or an offline one (called cold storage) to use Bitcoin. Web wallets are great for those who want to access their funds at any time from any computer with internet access; however, they’re more susceptible to hackers who may try to steal personal information. Cold storage is best suited for those who plan on holding onto their Bitcoins long-term—since it requires special software installed onto a computer not connected directly to the internet.

How Bitcoin differs from the other cryptocurrencies.

Bitcoin was the first cryptocurrency to gain wide popularity, and since then, several other cryptocurrencies have entered the market. These other cryptocurrencies are collectively known as Altcoins, and we can use hundreds of them for various purposes.

Altcoins differ from Bitcoin in several ways. While Bitcoin relies on a peer-to-peer network to record transactions and guard against double-spending, some altcoins rely on proof-of-stake consensus mechanisms to maintain security. Other altcoins use wholly different consensus mechanisms, such as delegated proof-of-stake or proof-of-importance.

Why do people consider Bitcoin?

There are many advantages to using Bitcoin and cryptocurrencies as a form of payment. While they may still be relatively new, they offer consumers and businesses alike a new way to transact without having to worry about the fees, exchange rates, and bureaucracies that come with using traditional currencies. Furthermore, Bitcoins aren’t subject to inflation or devaluation like conventional currencies are.

Although it has been gaining popularity since 2008, only recently has it risen to new levels of interest in both investors and consumers. As with any financial instrument or cryptocurrency, Bitcoin carries many benefits and drawbacks that you need to be aware of before participating in its economy. Whether you are simply looking for investing insights or considering investing in Bitcoin, finding out how to navigate the Bitcoin economy will help you save time, avoid mistakes, and hopefully make some money (or at least not lose it).

Bitcoin and other cryptocurrencies will change how we think about investing, business and money. The future success of alternative currencies like dogecoin depends on mass adoption. Although there are many pros and cons to cryptocurrencies, the advantages are hard to overlook when you take a step back. Currently, one of the most significant barriers to entry for this type of currency is its status as an emerging technology. It remains difficult for many people to understand or trust it. But if cryptocurrencies can overcome some of these flaws, many industry experts think we’ll see mainstream adoption in no time at all.

Read Next:

8 Tips for Saving Money After Retirement