Sponsored post.

Many moons ago, when I got my first checking account, my mom set me up for success by showing me how to balance it and budget my money. As with most people, the amount of money I have to account for has increased over the years – but with an increase in salary, there’s always an increase in expenses. I’ve switched to using a banking app and balancing my account online, making it easier than ever to ensure I’m not over budget. However, the last few months have been quite challenging, regardless of how easy it is to access the information.

With the increased cost of pretty much everything this year, I’ve found it harder to stay in the black every month. I had found a way to keep on track, but then I was placed on a new blood pressure medication, and that all changed. When I went to pick up the prescription, I was surprised to hear the average out-of-pocket cost for it was almost $23. Worse, it’s not a one-and-done; it’s a monthly script that I’ll have to account for each month. The pharmacist saw the amount – confirmed that it was the cost after insurance – and made a suggestion on a way I might be able to get the cost down. She said I should try to find a prescription discount card, so I had her put my prescription on hold and went home to do some research.

So Many Options… Which One was Right for Me?

Many people have heard of non-insurance prescription cards, and I knew there was more than one option available. I decided to make some comparisons, and the two I narrowed it down to based on savings and the number of locations were GoodRx and SingleCare.

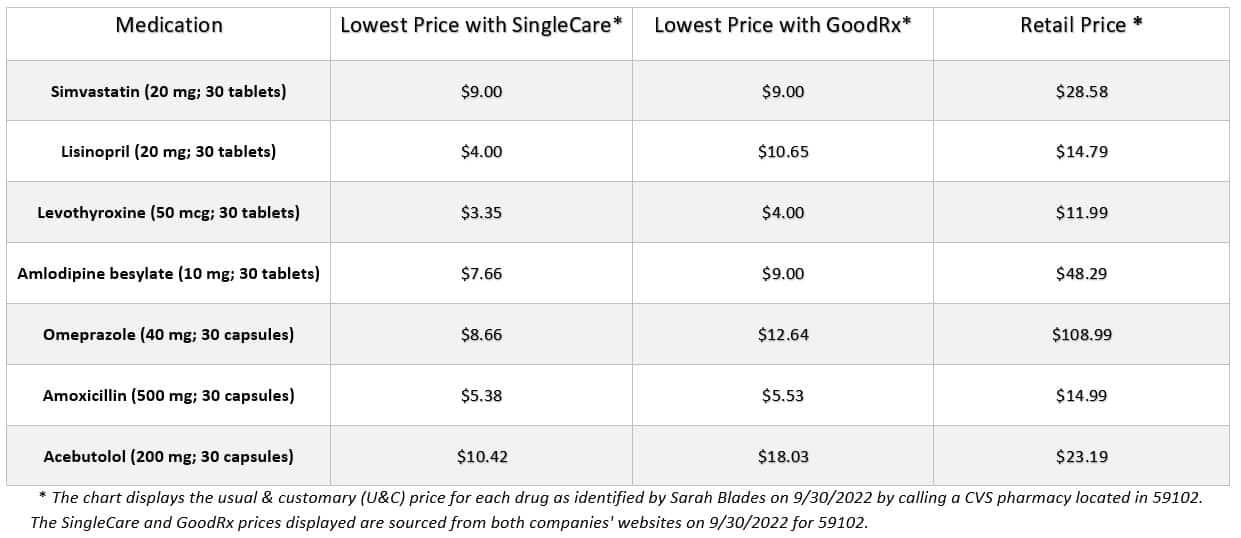

Among the top-rated prescription discount cards, both are pretty impressive. Both offer steep discounts on prescription medications and help you save money when you visit the pharmacy. Both are free to use (unless you opt for the premium service from GoodRx, which costs $5.99/month), and both have the option to download an app. Where they differ, though, is that GoodRx is available in more locations while SingleCare offers bigger discounts.

For me, I like convenience, but I LOVE saving money. In some cases, the difference wasn’t significant – just a few cents, but in others, you could save upwards of $5 more with the SingleCare card. In the case of my blood pressure medication, the difference was pretty substantial. At my local CVS pharmacy, where I get all my prescriptions filled, SingleCare would drop the cost down from around $23 to $10.42! GoodRx, on the other hand, only brought the price down to $18.03. An additional savings of almost $8 a month will add up over the course of a year (or longer), and it definitely made my mind up when choosing between the two.

Here are some example savings that I found while researching the different cards. While our family doesn’t use all of these medications, they’re some of the most popular on the market, and I felt they provided a good litmus test for cost comparison:

Which One Did I Choose?

In my case, the SingleCare card was the better choice, which I determined based on the cost savings I would see throughout the year. I also like the other benefits, which I found when I was researching the card on their website. These include:

- SingleCare can be used at 35,000+ pharmacies nationwide. While I obviously don’t need that many options, the list includes CVS (my go-to) and Costco, where we get some of my husband’s medications. The card and app are accepted at both places, which is very convenient.

- SingleCare offers discounts on 10,000+ generic and brand name drugs, including up to 80% off some medications. They even often beat the price of an insurance copay, which can spell significant savings when your insurance isn’t covering enough.

- The card can be used by the whole family, so I can use it for my husband’s monthly prescriptions as well as the occasional meds that my sick kiddos require.

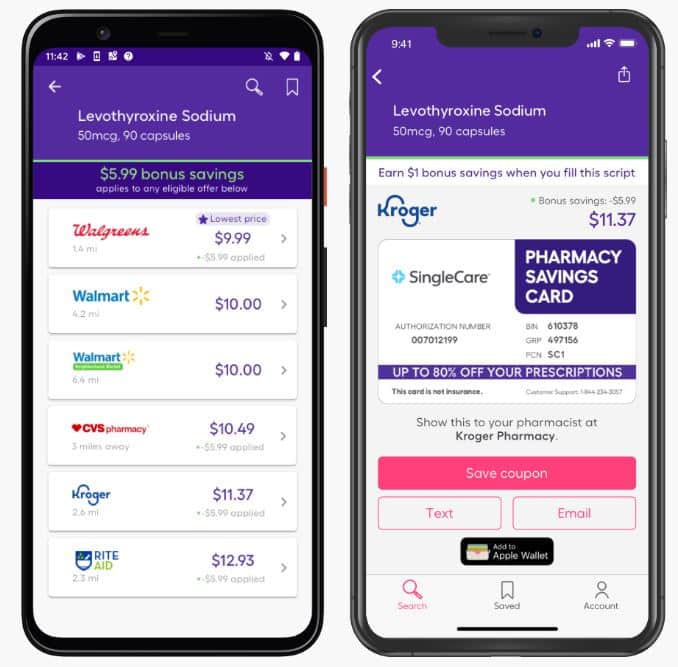

- SingleCare has a free loyalty program where users get a $5 bonus to use toward their first prescription, plus an additional $1 gets added to their account every time they use the card. (Also, note that the cost I listed earlier for my BP medication did NOT include the $5 first-time-use discount. That means I’ll see even bigger savings than my initial cost comparison showed.)

- They have an app for that. I have so many discount cards that clutter my wallet that I was pleased to find that SingleCare has an app for iOS and Android. So, I don’t have to carry the physical card; I can simply utilize the app on my phone and can easily look up and compare prices on the go.

The Bottom Line

When determining how to get prescription drug discounts, one no-brainer is to look into a prescription savings card. When choosing from the options, the obvious choice for me was SingleCare because of the cost savings and loyalty program. If I were to give a SingleCare review, I would give it 5 money-saving stars, and I encourage you to explore your options and see if you can get on the road to prescription savings.