Today women’s lifelong financial wellness is at a tipping point. Thanks to a seismic shift toward women’s growing personal and financial power, they are poised to move into true financial independence, enjoying all the freedom that it brings. Yet there is still a trail left to blaze. Women are living longer than ever before, and funding that longevity has truly become a women’s issue. As women seek more financial knowledge, confidence, and empowerment, they see money as more than just the bottom line. It’s a means to meet their responsibilities, reach their goals and take care of the people they love.

Women’s Financial Needs and Preferences are Distinct

This report explores how women’s financial needs and preferences are distinct. It examines the different life journeys women take — and the financial consequences of the circumstances and decisions they are faced with along the way. Finally, it shines a light on the importance of demonstrating respect and inclusion to facilitate a path to women’s financial freedom and wellness.

Our study uncovers how women’s superior longevity, multidimensional life journeys, and higher lifetime health and healthcare costs compound over time, as well as:

- Why the wealth gap is the biggest challenge we’re not talking about enough

- Women’s number one financial regret

- Why women need to be planning for a 100+ year life

- How the pay gap accumulates over the course of a woman’s lifetime

- How women’s diverse life journeys come with meaningful rewards and challenges

This report is the culmination of extensive research including a review of relevant publications and studies, interviews with experts, custom qualitative and quantitative research, and brainstorming sessions with Age Wave, Bank of America executives, and leading experts in the field. Our survey, fielded October 25 – November 22, 2017, was conducted by Merrill, in partnership with Age Wave, and executed by Kantar TNS utilizing the Kantar Lightspeed Panel, along with selected panel participants. The sample is nationally representative across the U.S. and comprises 3,707 respondents, including 2,638 women and 1,069 men over 18 years old, across all geographies and education, income, and asset levels. Sufficient samples of all ages, races/ethnicities and marital statuses were observed.

“We are committed to serving women clients. We offer customized financial solutions that consider a client’s individual life journey, wants and needs.” – Lorna Sabbia Head of Retirement & Personal Wealth Solutions, Bank of America

One Size Does Not Fit All

We recognize that women should not be bucketed as one voice and body. Throughout this report we aim to represent the voices of many women of diverse backgrounds. We’re also highlighting women at different places along their life journeys. Relationship, education and employment statuses are key differentiators in the lives of women that drive their financial priorities and values, and that may change, one or many times, throughout their lives.

Women have come a long way personally, professionally, and financially, but when it comes to finances, there’s still considerable work to be done to level the playing field. This report celebrates the progress made, deeply examines the specific financial challenges women face across their lifetimes, and offers potential solutions and actions for funding the present and future.

A Trail Left to Blaze

With media coverage and social momentum around women’s power and equality currently at the highest point in decades, it’s worth taking a moment to recognize how far women have come. In the not-so-distant past, American women couldn’t own property (up until 1862), vote (1920) or apply for individual credit cards (1974). Progress has been made, but there’s still a trail left to blaze. Women make less money. They also live longer than men yet accumulate less wealth to fund their longer lives.

“Women make more values-based decisions for themselves and their families, rather than just going for the bottom line. When you bring values into the conversation, it makes all the difference.” –Jeanette Schneider Senior Vice President & Private Client Advisor, U.S. Trust

At the tipping point

We have, however, reached a tipping point, thanks to a seismic shift toward women’s growing personal and financial power. Women are pioneers and are reshaping history every day. Today, women graduate in higher numbers than men from college and graduate school, accounting for 57% of recent degree earners.¹ Due in part to this rise in education, there has been a dramatic increase in women’s earnings, which grew by 75% compared to only 5% for men between 1970 and 2015.² By 2020, women will control $22T of wealth in the United States.³ In the decades to come, women are poised to achieve even greater financial empowerment and the independence and freedom it brings. Momentum is high, but there is still a trail left to blaze. Beyond the bottom line When it comes to money, women are about more than the bottom line. Yes, they care about performance, but they also see money as a way to finance the life they want to live—to meet their commitments to themselves and to the people and issues they care about. First and foremost, women report that when it comes to money, family is their priority; 77% of women say they see money in terms of what it can do for their families. When it comes to investing, about two-thirds (65%) of women say they want to invest in causes that matter to them. In fact, more than half (52%) of women investors are interested in or currently engaged in impact investing,* generating financial returns along with social returns, compared to 41% of men.⁴

Finances are Key to Greater Career Flexibility

Women also see the link between their finances and their careers. The majority of women (84%) say that understanding their finances is a key to greater career flexibility. Their bottom line: They want their relationship with money to be linked to their values, goals and priorities. *Impact investing and/or Environmental Social Governance (ESG) investing has certain risks based on the fact that ESG criteria excludes securities of certain issuers for nonfinancial reasons and therefore, investors may forgo some market opportunities and the universe of investments available will be smaller.

Confidence in All But Investing

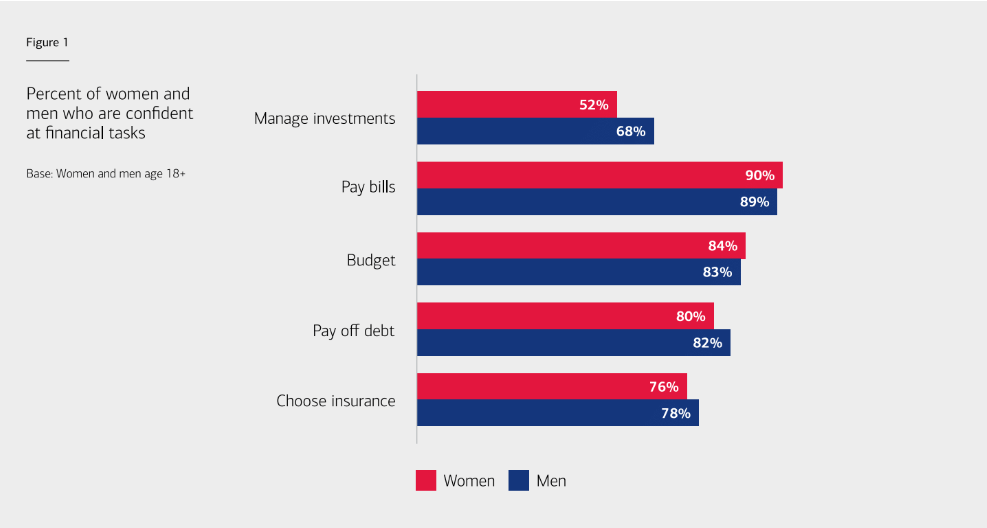

Our study shows that women are confident — equally as confident as men — in most financial tasks, such as paying bills (90%) and budgeting (84%) (Fig. 1). However, when it comes to managing investments, their confidence drops significantly: Only about half (52%) of women say they are confident in managing investments, and that is the largest gap (16%) between women and men reporting they are confident in specific financial tasks. There’s a social taboo around talking about money that adds to the lack of confidence. Sixty-one percent of women would rather talk about their own death than money. And 45% of women say they do not have a financial role model. The media, even women’s media, is largely complicit and does not often contribute to smart and open dialogue about money, lifelong wealth planning, and investing questions and needs. Case in point: Of 1,594 pages of editorial content in the March 2018 issues of the top 17 women’s magazines, there were only 5 pages covering personal finance.⁵ That’s less than 1%. And there’s more. Seventy percent of women surveyed report that the financial services industry has traditionally catered to men. Wealth planning models have defaulted to men’s salaries, career paths, family roles, life spans and preferences. Just one example: Retirement calculators do not allow for planned or unplanned breaks from the workforce — breaks taken more frequently by women — to raise children or care for aging family members.⁶

61% of women would rather talk about their own death than money.

Many Women’s Biggest Financial Regret

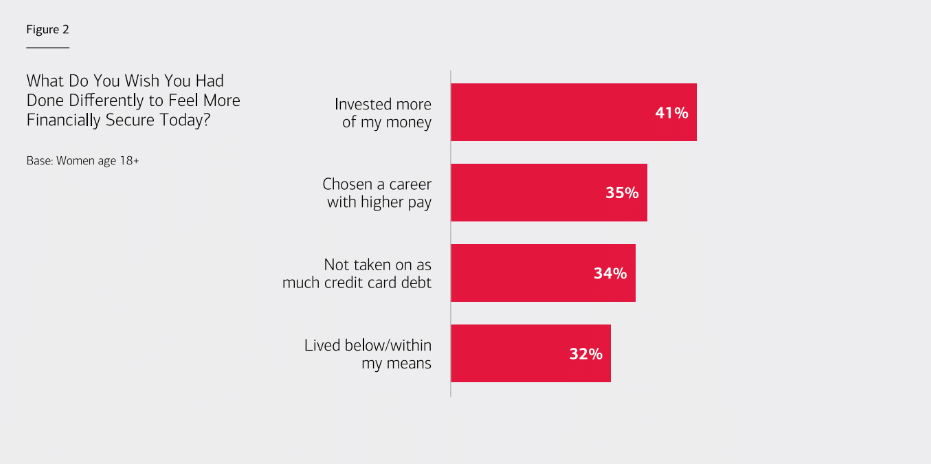

Women (41%) report that their biggest financial regret is not investing more. Investments provide the opportunity for women to grow their wealth in ways that income alone does not. Fifty-nine percent of women report that they are not doing a good job using investing as a way to pursue their financial goals. Women say that not having the knowledge to invest is their number one barrier (60%) followed by not having the confidence (34%). For the women who do invest, however, most (77%) report feeling they’ll be able to save enough money to last them the rest of their lives. While not investing enough is women’s top financial regret, it is not their only regret. Women also report that they wish they had chosen a career with higher pay, not taken on as much credit card debt, and lived within or  below their means (Fig. 2). This is true for women of all races and ethnicities. Forty-eight percent of Asian women, 41% of African American women, and 40% of both Caucasian and Latina women report that their biggest financial regret is not investing more of their money. The second-largest financial regret for African American and Asian women is not choosing a career with higher pay, and the second-largest regret for Caucasian and Latina women is taking on too much credit card debt. Women’s #1 financial regret is not investing more of their money.

below their means (Fig. 2). This is true for women of all races and ethnicities. Forty-eight percent of Asian women, 41% of African American women, and 40% of both Caucasian and Latina women report that their biggest financial regret is not investing more of their money. The second-largest financial regret for African American and Asian women is not choosing a career with higher pay, and the second-largest regret for Caucasian and Latina women is taking on too much credit card debt. Women’s #1 financial regret is not investing more of their money.

Confidence Can Trigger Action

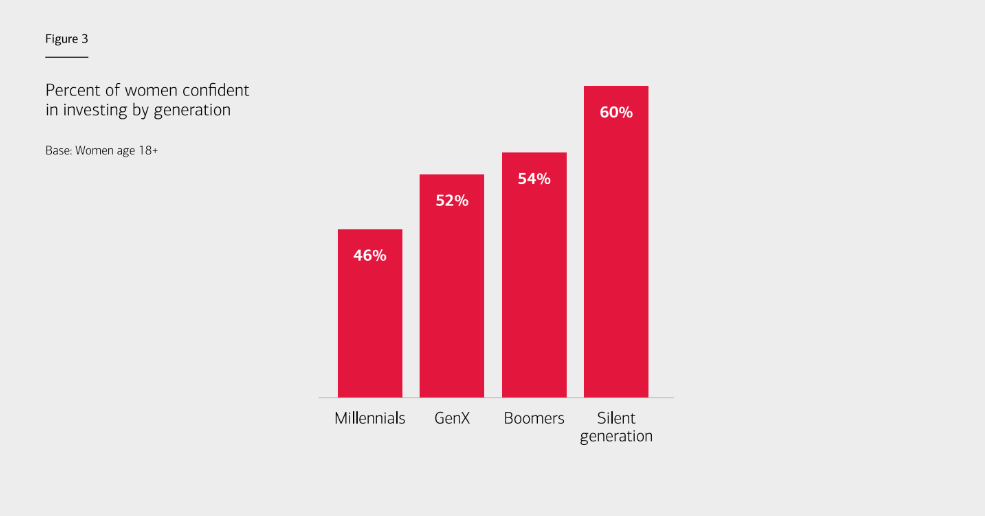

Studies have shown that confidence leads to action.⁷ Women and financial confidence is a well-trodden topic, with action being the missing link. The needle is not being moved for young women in particular; only 46% of Millennial women are confident in investing compared to older generations (Fig. 3). Confidence in investing is not just about experience but also exposure. Exposure can come from education. All women surveyed wish they had more education around money and finance, but Asian, African American and Latina women especially so. Forty-three percent of Asian women, 42% of Latina women and 41% of African American women wish they had educated themselves more around money, compared to 28% of Caucasian women. Financial education is important to nearly all women: Fully 87% of women say basic financial management should be a standard part of the high school curriculum.

“We need to instill a new set of life expectations for women.… Your only sure investment is an investment in yourself.” – Marina Adshade PhD, Author/Professor of Economics, University of British Columbia

There is a great opportunity being lost for younger women to learn from older women. Women across generations, families, and workplaces can help each other through sharing lessons learned and practical advice. Older women can help younger women as financial mentors and role models. The media and financial services, too, can help educate women by eliminating some of the taboo that still exists when talking about money.

Longer lives, smaller nest eggs

Longevity needs to be a factor in everyone’s financial strategies, but far more so for women, who, on average, live five years longer than men.⁸ In fact, 77% of people who are widowed are women.⁹ By age 85, women outnumber men two to one¹⁰ and the majority (81%) of centenarians are women.¹¹ This means that women are more likely to be alone and financially self-reliant in their later years, perhaps having already spent some of their nest egg on a partner’s health or end-of-life care costs. Over half of women (64%) say they’d like to live to 100, yet most (60%) fear they will run out of money if they do live that long. In fact, 42% of women are afraid they will run out of money by age 80. These fears are not unwarranted. The typical retirement costs $738,000,¹² yet only 9% of American women have $300,000 or more saved.¹³ Despite the fact that longevity is a critical women’s issue, and that women tell us they want to live long lives, when asked, “How far into the future have you planned for financially?” the findings are astonishing. One in four women ages 18 or older, and as many as 30% of women ages 30 to 44 — critical years for retirement savings — say they have not planned at all for their future.

“Longevity is a critical issue for women, probably one of the biggest reasons why women’s needs are so different than men’s in terms of financial saving and investing.” – Annamaria lusardi PhD, Academic Director, Global Financial Literacy Excellence Center, George Washington University

“The foundation of saving for retirement hasn’t changed to support the 100-year life. People aren’t thinking about this. We need to bring the story of long life and planning for it to our employees.” – Victoria Mazur Head of Compensation and Benefits, Lord Abbett

Women’s life journeys

Seventy percent of women say that women and men have fundamentally different life journeys. Together, Merrill and Age Wave have developed an innovative way of looking at how people traverse the journey of life. Most women will go through these life stages, sometimes experiencing them simultaneously — for example, spousal caregiving and retirement or parenting and elder caregiving.

Here, we apply a gender lens to show how at each life stage we explore, women are more likely to have specific financial setbacks as they make accommodations to care for family,¹⁴ while at the same time enjoying each step of their journey.

- Early Adulthood

- Parenting

- Elder Caregiving

- Retirement

- Spousal Caregiving

The rewards and risks throughout the journey While each life stage brings important rewards, including emotional fulfillment, each stage also presents risks, which can include key financial consequences.

Early adulthood

Early adulthood is about beginning to establish and maintain independence. Women now graduate from college and graduate school in higher numbers than men, boosting their career options.¹⁶ Today, 42% of women ages 18 to 64 have a bachelor’s degree or higher, up from 25% in 1992.¹⁷ However, one of the financial consequences of the increase in education is that women hold 64% of all student debt.¹⁸ Then, when they enter the workforce, many face the gender pay gap. It’s harder for women to save and subsequently invest if they are simultaneously paying down debt and accumulating less income.¹⁹ Fully 63% of women ages 18 to 29 say wealth planning is too difficult to even think about, yet 84% anticipate they will be more responsible for paying for their own retirement than their parents’ generation.

Early adulthood financial tips: Create and try to stick to a budget to manage expenses, have an emergency fund and save for long-term goals Find ways to reduce debt and establish a positive credit score Take advantage of employer-sponsored saving plans, such as a 401(k) and/or a Health Savings Account (HSA)

42% of women ages 18–64 have a bachelor’s degree or higher, up from 25% in 1992.

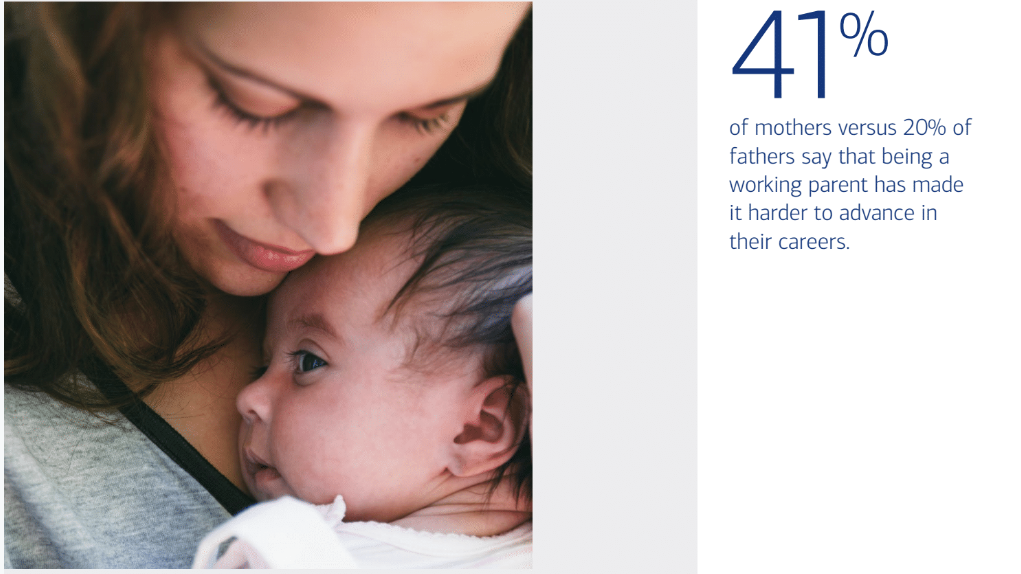

41% of mothers versus 20% of fathers say that being a working parent has made it harder to advance in their careers.

Parenting

Eighty percent of women have children during their lifetime,²⁰ and, on average, they have two children.²¹ Parenting is emotionally rewarding and fulfilling, but it also poses challenges for career trajectories and finances. Women are more likely to make tradeoffs for family than men are,²² and mothers experience a “mommy penalty,” a pay gap that is three times that of non-mothers due to lost income and missed opportunities for promotions caused by breaks from the workforce.²³ Forty-one percent of mothers vs. only 20% of fathers say that being a working parent has made it harder to advance in their careers.²⁴ One in three mothers we surveyed who returned to the workforce after caring for their children say they took on less demanding work, which resulted in lower pay, and 21% of those mothers say they were paid less for the same work they did previously.  Parenting often results in women being time-poor, acutely so when their children are young or when they’re single mothers. As recently as 2016, mothers of children under six reported dedicating nearly twice the amount of time per day as fathers spent dedicated to childcare, including when both parents work.²⁵ In more than half (54%) of homes where both parents work full time, the mother does more to manage children’s schedules and activities.²⁶ That leaves less time for financial management, planning, saving and investing during critical years that can help build a nest egg.

Parenting often results in women being time-poor, acutely so when their children are young or when they’re single mothers. As recently as 2016, mothers of children under six reported dedicating nearly twice the amount of time per day as fathers spent dedicated to childcare, including when both parents work.²⁵ In more than half (54%) of homes where both parents work full time, the mother does more to manage children’s schedules and activities.²⁶ That leaves less time for financial management, planning, saving and investing during critical years that can help build a nest egg.

Parenting financial tips: Expect potential career interruptions and plan accordingly Plan ahead for children’s education— consider a tax-efficient 529 savings plan Be a financial role model: Create a will, power of attorney, healthcare proxy and medical directives

Elder caregiving

Two-thirds of care provided to older adults is done by women,²⁷ whether to a parent, grandparent, parent-in-law or other family member or friend. Caregivers overwhelmingly report that it gives them a sense of purpose and that they are grateful for the opportunity to provide care,²⁸ but it can also be stressful and financially challenging. Like parenting, it requires attention, tradeoffs and emotional commitment. Caregivers are also time-poor, especially if they are sandwiched between caring for their own children and caring for their parents or older relatives. Caregiving can lead to lost benefits and promotions if work interruptions occur, in addition to out-of-pocket costs. The average caregiver spends $7,000 per year on their care recipient,²⁹ which can diminish long-term savings for the person providing care. Depending on the length of care, this can be a significant financial strain.

Elder caregiving financial tips

Elder caregiving financial tips

Talk openly with family about their wishes for later life Secure necessary legal authorization (e.g., power of attorney) to fulfill financial and healthcare tasks and where to access important financial and health documents Gain an understanding of Medicare and also of long-term care options —such as housing and hands-on care — as the needs of the loved one change over time.

Retirement

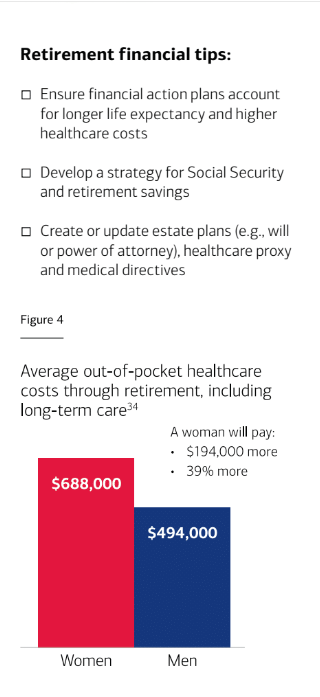

Women face a retirement paradox: They live longer and may have a much longer retirement, which gives them more years to enjoy the flexibility, freedom and leisure of this life stage.³⁰ On the other hand, women on average enter retirement two years earlier than men, with less savings.³¹ Women are equally likely to participate in 401(k)s and retirement plans if they have access to them.³² Work interruptions for providing care and part-time employment can limit access to employer-sponsored retirement plans.³³ Women could get a retirement bonus if they invest in their 401(k) early and delay retirement. Alternately, there could be a major setback if they retire too early and have not invested fully in their 401(k), relying instead on their lower levels of savings for longer. Another financial challenge women need to plan for is that the average woman will have 39% higher health costs than the average man in retirement, paying an additional $194,000 (Fig. 4).³⁴ This is because women retire earlier, live longer and are more likely to spend years alone and have to rely on formal long-term care in their later years.³⁵ Adding even more complexity to the healthcare equation, women are more likely to have multiple chronic conditions,³⁶ and women over 65 have two times the estimated lifetime risk of developing Alzheimer’s disease compared to men.³⁷

Women face a retirement paradox: They live longer and may have a much longer retirement, which gives them more years to enjoy the flexibility, freedom and leisure of this life stage.³⁰ On the other hand, women on average enter retirement two years earlier than men, with less savings.³¹ Women are equally likely to participate in 401(k)s and retirement plans if they have access to them.³² Work interruptions for providing care and part-time employment can limit access to employer-sponsored retirement plans.³³ Women could get a retirement bonus if they invest in their 401(k) early and delay retirement. Alternately, there could be a major setback if they retire too early and have not invested fully in their 401(k), relying instead on their lower levels of savings for longer. Another financial challenge women need to plan for is that the average woman will have 39% higher health costs than the average man in retirement, paying an additional $194,000 (Fig. 4).³⁴ This is because women retire earlier, live longer and are more likely to spend years alone and have to rely on formal long-term care in their later years.³⁵ Adding even more complexity to the healthcare equation, women are more likely to have multiple chronic conditions,³⁶ and women over 65 have two times the estimated lifetime risk of developing Alzheimer’s disease compared to men.³⁷

Spousal caregiving

Women often become caregivers to their own spouses/partners as they age together, since women marry men that are, on average, two years older³⁸ and they live, on average, five years longer than men do.³⁹ Women who provide this care feel the love and honor of caregiving and protecting the dignity of their spouse/partner. At the same time, providing this care may have significant financial consequences: It can deplete her nest egg and force her into the additional role of financial caregiver to her spouse.

Spousal caregivers may need to leave the workforce earlier than planned, and there is a toll on caregivers affecting their physical and mental health for the future. Additionally, as compared to other caregiving relationships, a woman caring for her spouse/partner is less likely to have additional support from family members or paid homecare workers to help share the load.⁴⁰ In addition to juggling the demands of work and caring for children, spouses, and other family and friends over the course of their life journeys, it is essential that women create a plan to save for their own 100-year lives.

Funding women’s life journeys: uncovering the realities

Women’s life journeys through early adulthood, parenting, elder caregiving, retirement, and spousal caregiving necessitate wealth planning for lifelong security and peace of mind. Women face some very specific challenges along the way.

The pay gap compounds over a lifetime

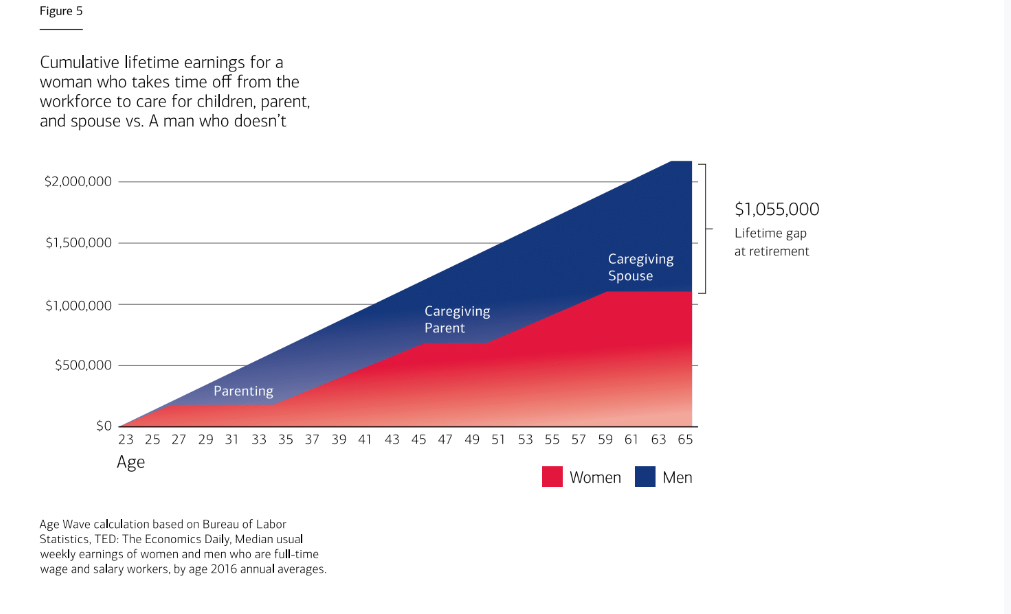

There’s a lot of talk regarding the gender pay gap: For every $1 a man makes, a woman in a similar position earns 82¢.⁴¹ Women of color face even greater disparities — African American and Latina women earn 70¢ and 64¢ on the dollar, respectively.⁴²  But that’s only part of the story: The pay gap only considers what women are now earning compared to men. It fails to demonstrate how the pay gap accumulates and compounds over the course of a woman’s life. Looking at the pay gap alone is a limited, conventional picture because it does not account for gaps in workforce participation. An average woman spends 44% of her adult life out of the workforce compared to 28% for a man.⁴³ Work disruptions and interruptions — often triggered by the need to care for children, parents, and spouses — affect a woman’s potential earnings over her lifetime. These gaps become relatively impossible to make up and reach parity with men who do not take time away from the workforce to provide care. The pay differential accumulates across a woman’s life and grows even more impactful when she reduces hours or takes time out of the workforce. Some women never take time away from the workforce for any period of time. For people who do leave work temporarily or permanently to care for family, it’s most often a woman.

But that’s only part of the story: The pay gap only considers what women are now earning compared to men. It fails to demonstrate how the pay gap accumulates and compounds over the course of a woman’s life. Looking at the pay gap alone is a limited, conventional picture because it does not account for gaps in workforce participation. An average woman spends 44% of her adult life out of the workforce compared to 28% for a man.⁴³ Work disruptions and interruptions — often triggered by the need to care for children, parents, and spouses — affect a woman’s potential earnings over her lifetime. These gaps become relatively impossible to make up and reach parity with men who do not take time away from the workforce to provide care. The pay differential accumulates across a woman’s life and grows even more impactful when she reduces hours or takes time out of the workforce. Some women never take time away from the workforce for any period of time. For people who do leave work temporarily or permanently to care for family, it’s most often a woman.

An average woman spends 44% of her adult life out of the workforce compared to 28% for a man.

The cumulative pay gap

Men also make sacrifices for family, but they don’t tend to have the same financial consequences. For example, consider a woman and a man who both earn median wages: While the average man continues to work full time at median wages continuously until retirement age, a woman could experience three key work interruptions:⁴⁴

- In her 20s or 30s, she takes eight years out of the workforce to care for two children.

- In her late 40s or 50s, she stops working for four years while she is caring for a parent.

- In her early 60s, she retires two years earlier than planned to care for her spouse.

Taken together, when she reaches retirement age, she’ll have earned a cumulative $1,055,000 less than a man who has stayed continuously in the workforce, due to the accumulated lifelong pay gap and workforce interruptions (Fig. 5). When a woman reaches retirement age, she may have earned a cumulative $1,055,000 less than a man who has stayed continuously in the workforce.

Building wealth is about funding one’s present and future self and having financial security throughout it all.

Women’s even larger wealth gap

Women’s financial security is about more than the pay they earn. What we’re not talking enough about, what we see less of in the media, and what many don’t even know exists is the even larger gender wealth gap. What is the wealth gap? It’s the difference between women’s and men’s total sum of all sources of financial resources, including earnings, investments, retirement savings and additional assets such as property. Today, the average single woman has three times less wealth than the average single man.⁴⁵ The gap persists among women and men of similar levels of education and age.⁴⁶ The wealth gap is not about being wealthy; It’s about the difference between men’s and women’s accumulated assets. More importantly, building wealth is about funding one’s present and future self and having financial security throughout it all.

A missing link: wealth escalators

The wealth gap is due, in part, to women’s lack of access to what are called wealth escalators.⁴⁷ Wealth escalators are on-ramps for people to build wealth beyond their income. They include fringe benefits from employment, government benefits and favorable tax codes, all of which have been proven to be more easily accessible to men than women.⁴⁸ Wealth escalators derive from career choices and promotions that men are more likely to take advantage of or be offered. In addition, women’s work interruptions create ripple effects: There are negative impacts on their wealth escalators, including benefits like Social Security, pre-tax savings opportunities such as 401(k)s, 529s and HSAs, and other benefits like medical insurance and paid time off.⁴⁹ In addition to the wealth gap, women face a potential penalty when they enter retirement—particularly due to Social Security, which is calculated by taking into consideration a person’s 35 highest-earning years.⁵⁰ For women, however, this fails to recognize their complex life journeys, which often involve time out of the workforce to care for family. Women are twice as likely as men to have at least one zero-earning year count toward their Social Security.⁵¹ As a result, the wealth gap continues even when Social Security kicks in, with women on average receiving $4,000 less annually than men.⁵²

Funding the journey

Women’s longevity, compounded by the pay and wealth gaps, makes it even more critical for women to take the necessary steps to achieve financial wellness. Women regret not investing more of their money and are looking for financial education and solutions that align with their values and priorities, as well as their bottom line.

Taking the next steps to achieve financial wellness

Women’s financial independence and empowerment are at a tipping point. At a time when women are more financially formidable than ever before, there is still room for progress. In order to maintain this upward trajectory and continue improving women’s financial lives, challenges must be unearthed, understood and addressed and we can all play a role.

Women can:

- Break the taboo around money talk. Encourage conversation between friends, family, and financial professionals, and in the press and in schools. Seek mentors and learn more

about money and finances. - Turn longevity into an asset. Start a retirement plan as early as you can, take advantage of tax-efficient retirement plan options such as 401(k)s that provide the opportunity to grow with compound interest, work longer, if possible and maximize Social Security and pension benefits.

- Acknowledge financial challenges that impact women. These can include career interruptions, longer lives to fund, or increased healthcare costs. Save and plan for these eventualities.

- Plan early and often. Consult a professional, discuss life priorities and goals, create a plan that matches any unique circumstances and revisit that plan often and make course corrections along the way.

For many, including husbands and partners, the financial industry, employers, policy makers, the press and the broad community that collectively can make an impact: Be part of the solution. Respect women’s different life journeys and longer life spans, their growing financial empowerment and that they are not all the same. Encourage financial discussions, facilitate financial education and confidence, demand equality in pay and promotions and play your part in achieving gender parity.

>READ: MINIMIZING THE FINANCIAL IMPACT OF DIVORCE

>READ: ELDERCARE: WILL YOU BE READY?

1 National Center for Education Statistics, 2016 2 U.S. Census Bureau, Historical Income Tables, 2015 3 BMO Wealth Institute, 2015 4 U.S. Trust, Insights on Wealth and Worth, 2017 5 Age Wave review of 17 leading women’s magazines, 2018 6 Age Wave review of 19 retirement calculators, 2018 7 Kay & Shipman, The Confidence Code, Harper Business: New York, 2014 8 Centers for Disease Control, National Vital Health Statistics: Life Expectancy, 2016 9 U.S. Census Bureau, Current Population Survey, 2016 10 U.S. Census Bureau, Population Estimates, 2015 11 Ibid. 12 Age Wave and Merrill, Finances in Retirement, 2017 13 GoBankingRates Survey, 2016 14 Pew Research Center, Women More than Men Adjust Their Careers for Family Life, 2015 15 We define early adulthood as 18-34 years old 16 National Center for Education Statistics, 2015 17 Bureau of Labor Statistics, Current Population Survey, Women’s Bureau 2014 18 American Association of University Women, Deeper in Debt: Women and Student Loans, 2017 19 Ibid. 20 Centers for Disease Control, National Vital Health Statistics, 2016 21 U.S. Census Bureau, Current Population Survey, Families and Households, Historical tables, 2017 22 Budig. The Fatherhood Bonus and the Motherhood Penalty: Parenthood and the Gender Gap in Pay, 2014 23 Correll, et al. “Getting a Job: Is There a Motherhood Penalty?” American Journal of Sociology, Vol. 112(5), 2007 24 Pew Research Center, Raising Kids and Running a Household: How Working Parents Share the Load, 2015 25 Bureau of Labor Statistics, American Time Use Survey, 2016 26 Pew Research Center, Raising Kids and Running a Household: How Working Parents Share the Load, 2015 27 Family Caregiver Alliance, Facts and Figures, 2015 28 Age Wave and Merrill, The Journey of Caregiving: Honor, Responsibility and Financial Complexity, 2017 29 AARP, Family Caregiving and Out of Pocket Costs, 2016 30 Age Wave and Merrill, Life Priorities in Retirement Research Series, 2014-2017 31 Center for Retirement Research, Boston College, “The Average Retirement Age—An Update,” 2015 32 Chang. Shortchanged: Why Women Have Less Wealth and What Can Be Done About It, Oxford University Press: Oxford, 2010; Brown et al., Shortchanged in Retirement: Continuing Challenges to Women’s Financial Future, National Institute on Retirement Security, 2016 33 Brown et al., Shortchanged in Retirement: Continuing Challenges to Women’s Financial Future, National Institute on Retirement Security, 2016 34 Age Wave estimate, based off Yamamoto, D.H., Health Care Costs—From Birth to Death, Health Care Cost Institute Report, 2013; HealthView, Retirement Healthcare Costs Data Report, 2016-2017 35 Bureau of Labor Statistics, Current Population Survey, 2017 36 Salive. “Multimorbidity in Older Adults,” Epidemiologic Reviews, Vol. 35 (1), 2013; Buttorff. Multiple Chronic Conditions in the United States, RAND Corporation, 2017 37 Alzheimer’s Association, 2017 38 U.S. Census Bureau, Current Population Survey Supplement, 2015 39 Centers for Disease Control, National Vital Health Statistics: Life Expectancy, 2016 40 Age Wave and Merrill, The Journey of Caregiving: Honor, Responsibility and Financial Complexity, 2017 41 Bureau of Labor Statistics, Current Population Survey, Women’s Bureau, 2016 42 Ibid. 43 Age Wave Estimate, Bureau of Labor Statistics, Number of Jobs, Labor Market Experience, and Earnings Growth: Results from a National Longitudinal Survey, 2017 44 Age Wave calculation, based on women’s and men’s full-time median wages, where a man works uninterrupted throughout his career, and a woman takes time off for the listed scenarios 45 Chang. Women and Wealth, Asset Funders Network, 2015 46 Ibid. 47 Chang. Shortchanged: Why Women Have Less Wealth and What Can Be Done About It, Oxford University Press: Oxford, 2010 48 Chang. Women and Wealth, Asset Funders Network, 2015 49 Ibid. 50 Social Security Administration, 2017 51 Ibid. 52 Social Security Administration, Fact Sheet: Social Security Is Important to Women, 2016

About Merrill Lynch Wealth Management Merrill Lynch Wealth Management is a leading provider of comprehensive wealth management and investment services for individuals and businesses globally. With 14,690 financial advisors and $2.4 trillion in client balances as of June 30, 2019, it is among the largest businesses of its kind in the world. Bank of America Corporation, through its subsidiaries, specializes in goals-based wealth management, including planning for retirement, education, legacy, and other life goals through investment, cash and credit management. Within this business, Merrill Private Wealth Management focuses on the unique and personalized needs of wealthy individuals, families and their businesses. These clients are served by approximately 200 highly specialized private wealth advisor teams, along with experts in areas such as investment management, concentrated stock management and intergenerational wealth transfer strategies. Merrill Lynch Wealth Management is part of Bank of America Corporation.

About Age Wave Age Wave is the nation’s foremost thought leader on population aging and its profound business, social, financial, healthcare, workforce and cultural implications. Under the leadership of Founders Dr. Ken Dychtwald, Ph.D., CEO, and Maddy Dychtwald, Senior Vice President, Age Wave has developed a unique understanding of new generations of maturing consumers and workers and their expectations, attitudes, hopes and fears regarding their longer lives. Since its inception in 1986, the firm has provided breakthrough research, compelling presentations, award-winning communications, education and training systems, and results-driven marketing and consulting initiatives to over half the Fortune 500. Age Wave is not affiliated with Bank of America Corporation.

A Merrill study, conducted in partnership with Age Wave. This article first appeared on Merrill Lynch.